Jason Miller

Michigan State University

Associate Professor, Supply Chain Management

Every month, Jason Miller will release a Trucking Market Update covering demand conditions, supply conditions, and price as it pertains to the trucking industry. In addition, each month will feature bonus content consisting of Jason’s thoughts on a new topic beyond the “big three” categories.

Demand Conditions

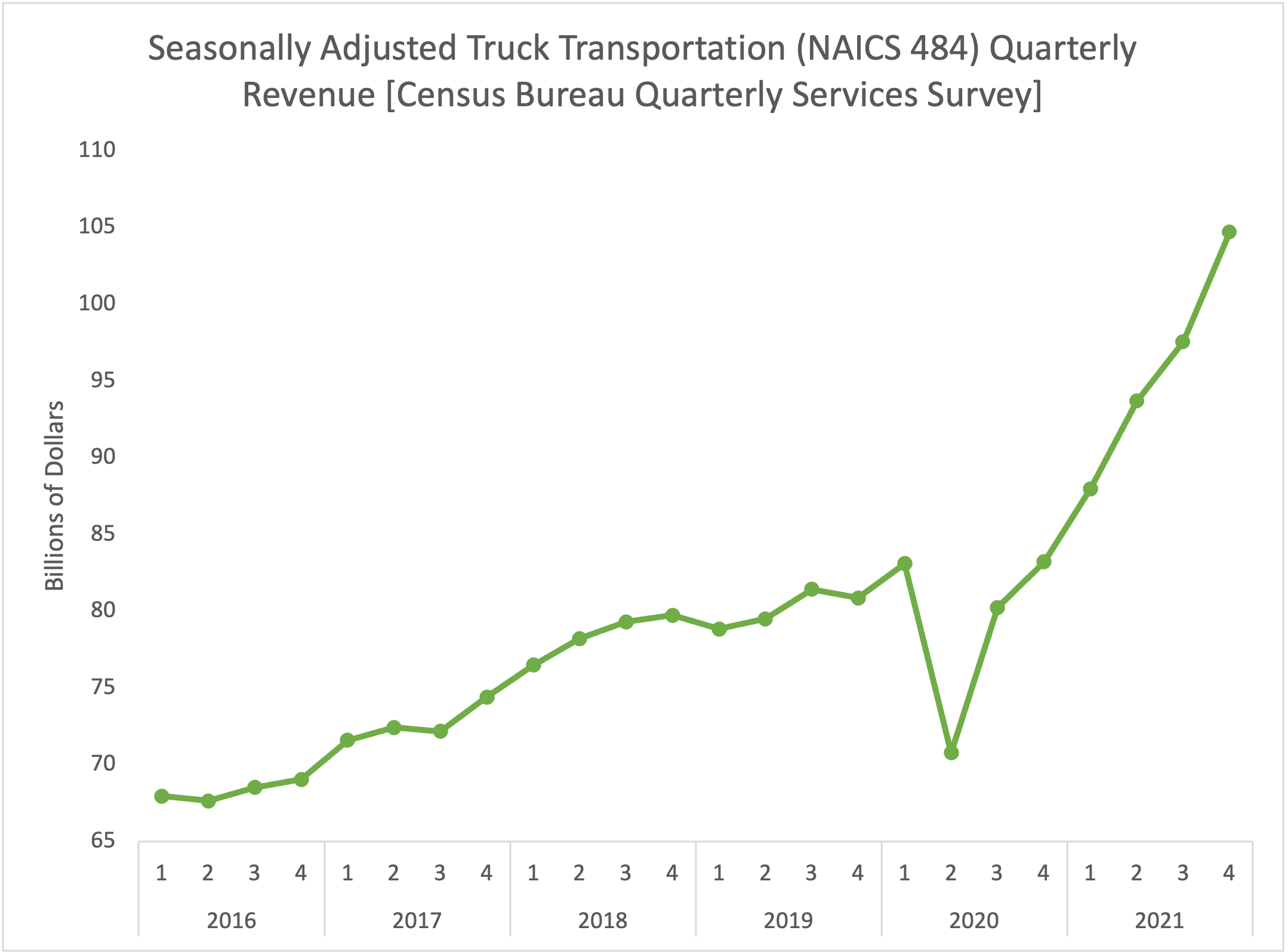

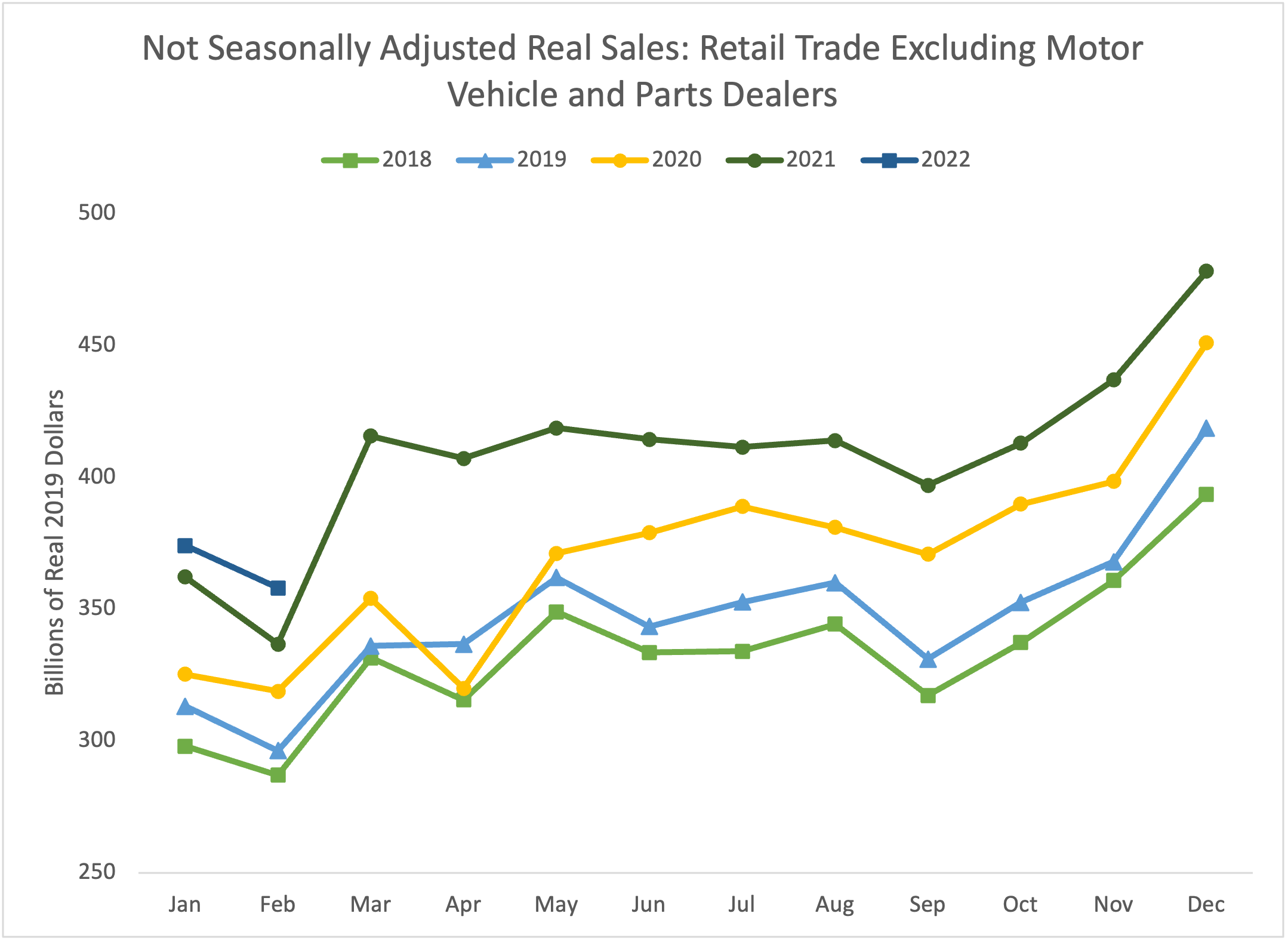

The Census Bureau’s Quarterly Services Survey, recently released for the fourth quarter of 2021, illustrates how strong a year 2021 was for carriers. Seasonally adjusted revenue for the fourth quarter of 2021 was 19% higher than the fourth quarter of 2020. In comparison, the second quarter of 2018—the height of the prior bull market cycle, saw revenue increase just 8% from the second quarter of 2017. However, the majority of this revenue increase was driven by rates rising much more rapidly in 2021 than in 2018, as opposed to more rapid volume gains. In terms of freight volumes in March, as of writing this during the week of March 21, there are some signs emerging that capacity is looser than in February (and certainly relative to January). However, we do not have visibility as to whether this is due to demand, supply, or both. For carriers with substantial exposure to retail freight, one thing to keep in mind is that March will likely be the first month where retail sales, once inflation is removed, are down from their corresponding monthly levels in 2021. This can be seen in the second plot, where it seems highly unlikely that we will see a substantial jump in March 2022 retail sales given no stimulus efforts are forthcoming.

Supply Conditions

On the supply side, despite substantial downward revisions to January 2022’s initial employment figures, data from the Bureau of Labor Statistics’ Current Employment Statistics program indicates employment at establishments that primarily engage in truck transportation are substantially above where they were just before the pandemic. As would be expected given the consumer-oriented nature of demand since the onset of COVID-19, the gains have been more pronounced in the general freight sector, especially...

© 2022 Randall Reilly